HMRC notes (pages 16, 39 and 40) ct600-guide

Note:

Amounts Surrendered as Group Relief

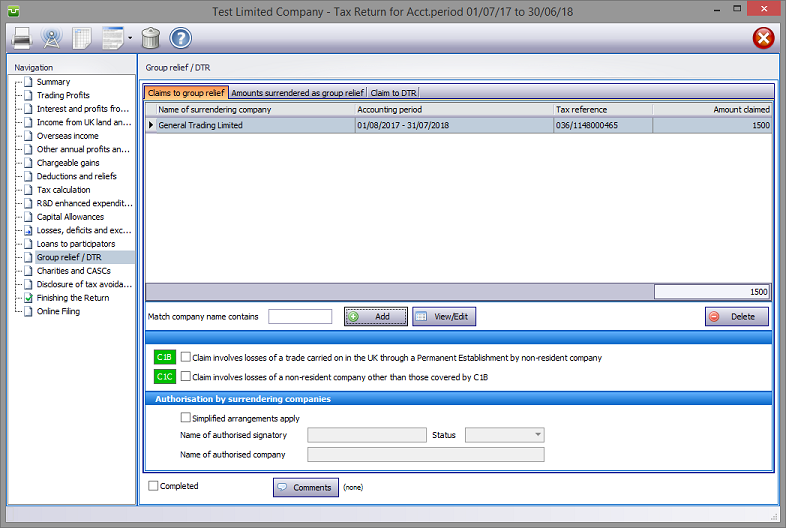

In the Navigation pane click on Group Relief/DTR and select the relevant tab.

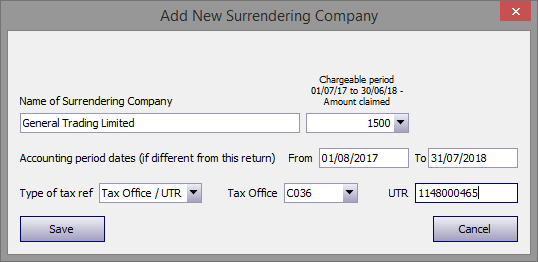

Hit the Add button which brings up the Add New Surrendering Company screen and enter the details of the company within the group surrendering relief.

If the accounting dates are the same as the return, leave the date boxes blank. Otherwise enter the period dates but please note that the Accounting period of the surrendering company 'To' date must be on or after the period covered by the return 'From' date.

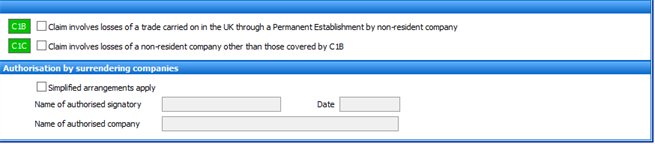

Check boxes C1B or C1C as appropriate.

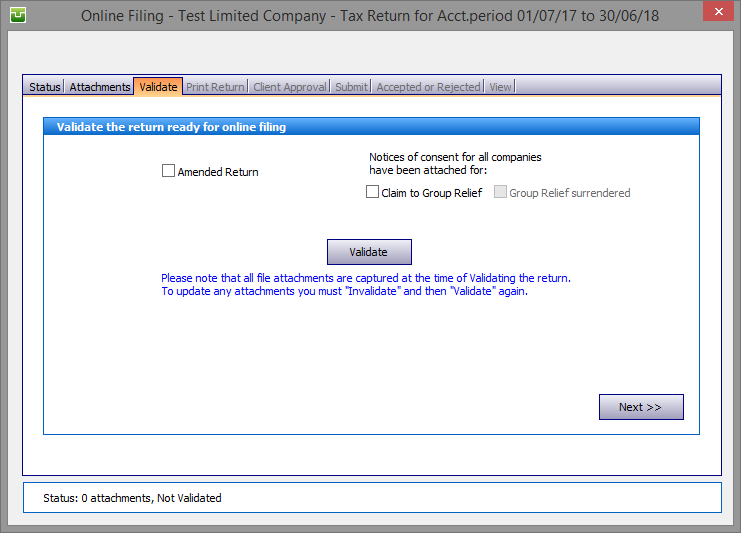

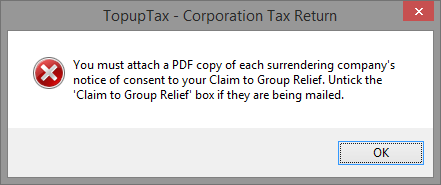

For Claims to Group Relief the consent options are:

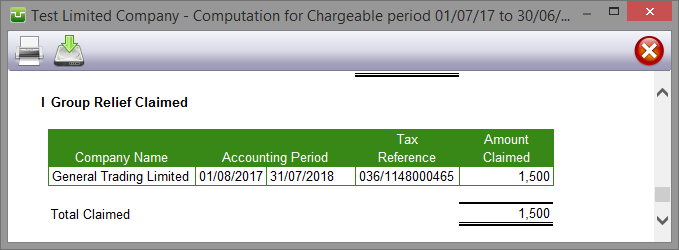

Computation summarises Group Relief Claimed.

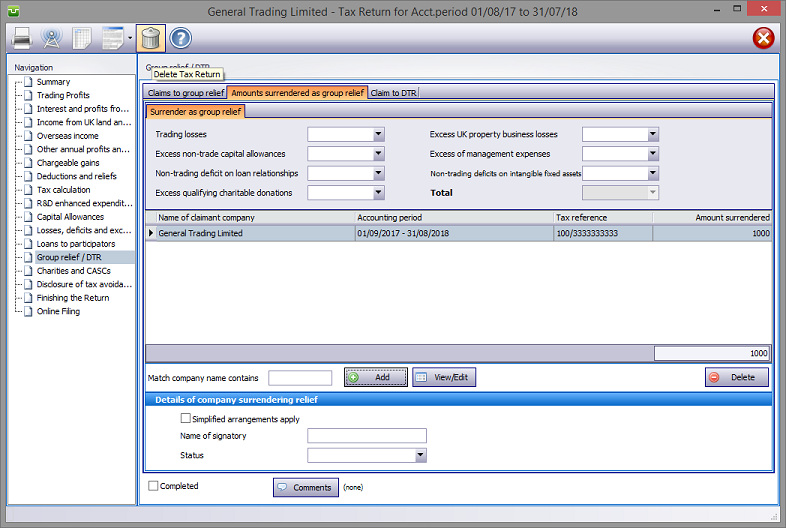

Amounts Surrendered as Group Relief

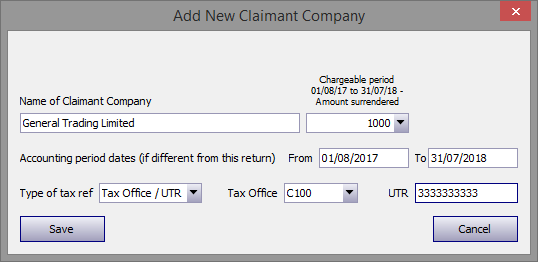

Hit the Add button which brings up the Add New Claimant Company screen and enter details of the company within the group. to which relief is being surrendered.

If the accounting dates are the same as the return, leave the date boxes blank. Otherwise enter the period dates but please note the Accounting period of claimant company 'To' date must be on or after the return period 'From' date.

For Amounts Surrendered as Group Relief the mandatory consent options are:

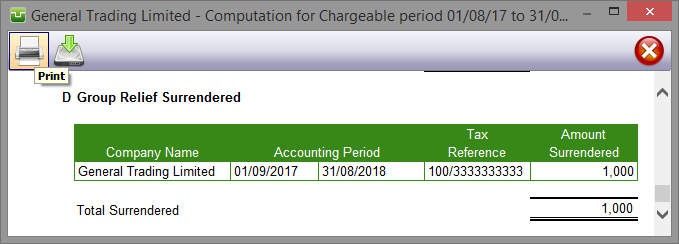

Computation summarises Amounts Surrendered as Group Relief.

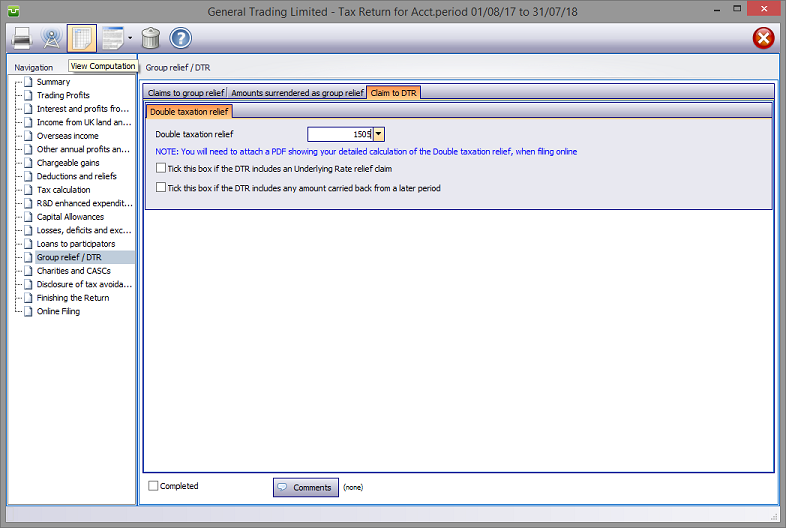

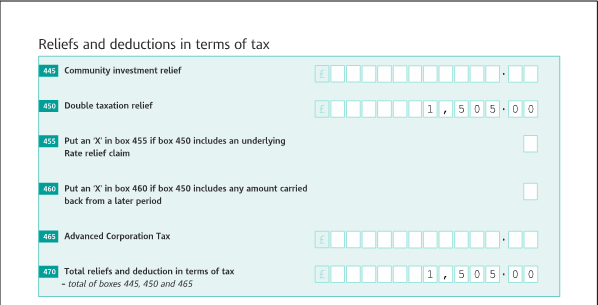

This feature enables completion of boxes 450, 455 and 460 on form CT600 V3. For form CT600 V2

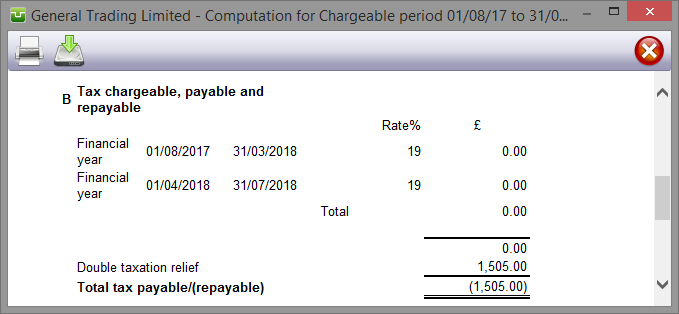

Because of the possible complexity of the calculations the user is responsible for computing the relief to DTR and attaching this to the return during the Online process. Please note that box 73 CT600 V2 will include the total of any EUFT plus the claim to DTR figure.

Checking the tick boxes enables entries in boxes 455 and 460.

Computation summarises DTR claimed.

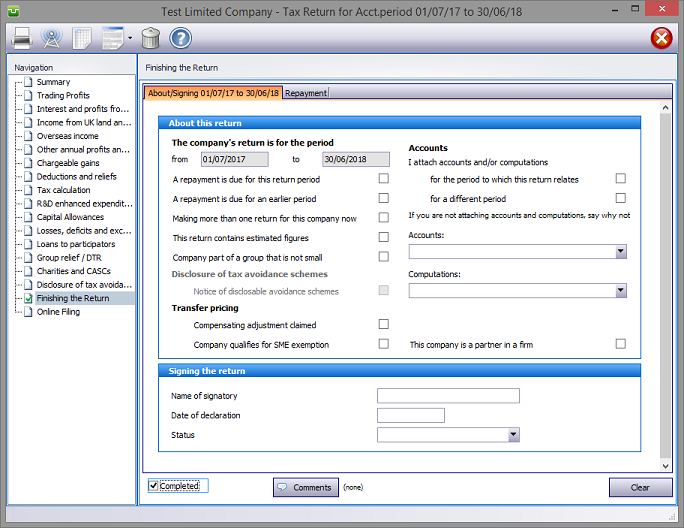

Finishing

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of comments appear to the right of the relevant boxes.

(pages 16, 39 and 40) CT600-guide

Copyright © 2025 Topup Software Limited All rights reserved.