HMRC notes - ct600-guide

Under the Tax Returns heading on the left hand pane of the main screen select Online Filing

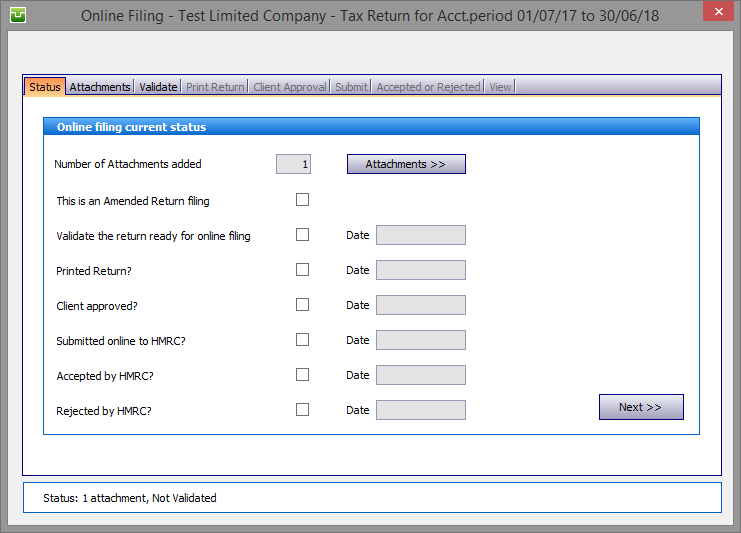

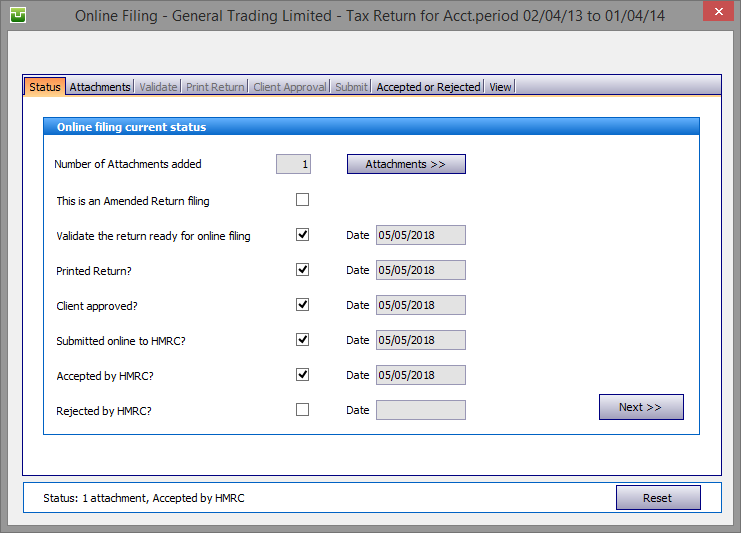

Status

This screen records progress of the online submission process.

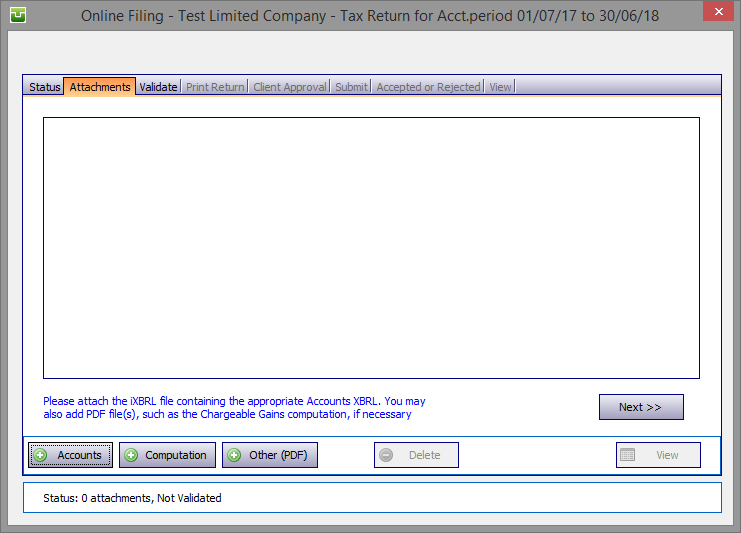

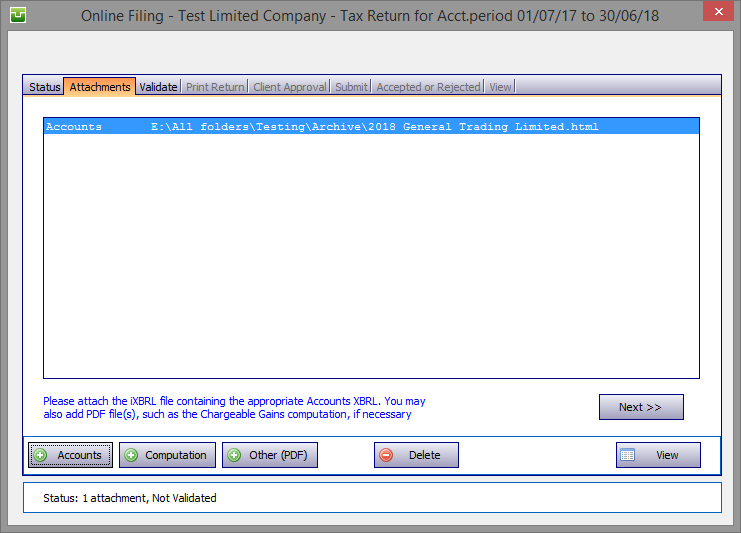

Attachments

It is a mandatory requirement that a set of accounts in IXBRL format are attached to the CT600 submission. Proceed by clicking on the Attachments tab, then on the Accounts button in the left hand corner of the screen.

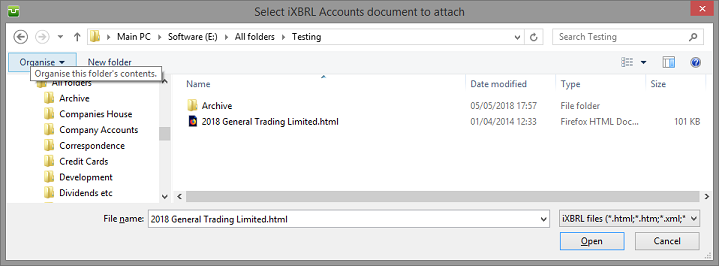

Use the Windows search facility to locate and select the relevant file.

The View button in the bottom right hand corner of the screen is now accessible and is used to check the content of the PDF attachment. Note that this button disappears once the return has been validated, see below.

Although the program automatically produces tax computations in IXBRL format you may wish to attach alternate computations in either IXBRL or PDF formats. If so click on either the Computation or Other (PDF) buttons to locate and select the relevant files.

Next either click on the Next button on the Attachments tab or on the Validate tab.

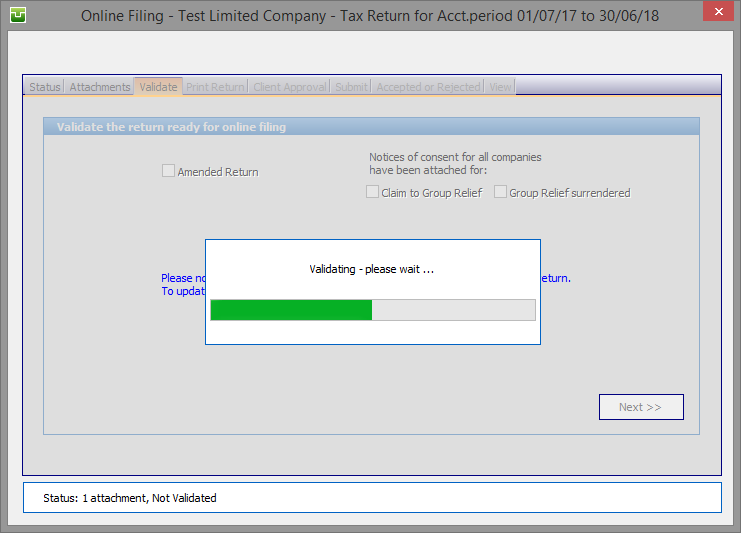

Validate

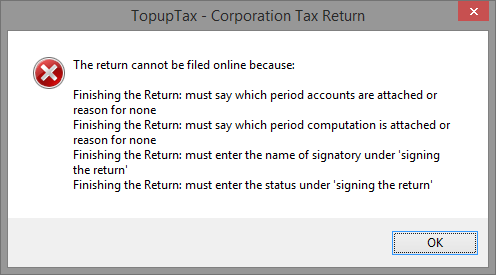

Click on the Validate button, if there are any uncompleted sections the online process will not proceed, this screen advises which sections remain "open".

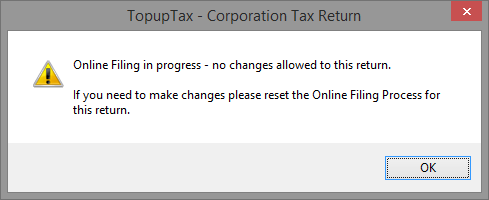

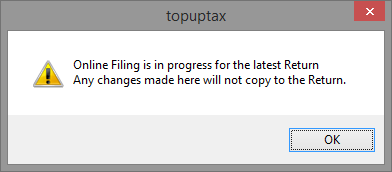

Once the online process has begun it will not be possible to make any changes to the tax return and clicking on View/Edit Tax Return brings up this screen.

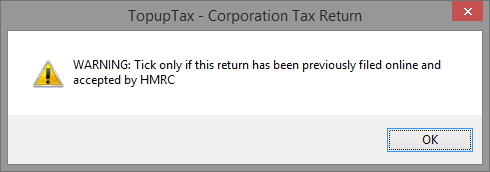

Clicking on the Main Details of the client brings up this screen.

If, for any reason, you wish to stop the online process (perhaps because further entries are to be made to the return) click on the Invalidate button. All entries on the Status tab will then clear and the process must recommence.

Otherwise click on the Next button on the Finalise tab or on the Print Return tab.

Amended Return

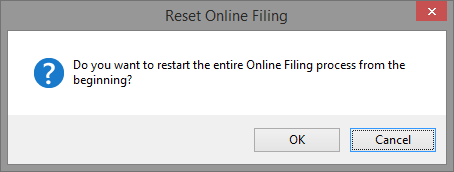

If you need to submit an amended return you must first go to either the Status or the Accepted or Rejected tabs and hit the Reset button. Before proceeding the program requests confirmation that you wish to restart the entire online process. Clicking on the OK button clears all entries on the Status tab.

Continue by adding attachment(s) as appropriate and move to the Validate tab. Check the Amended Return tick box and click on the Validate button. Proceed to print the amended forms etc.

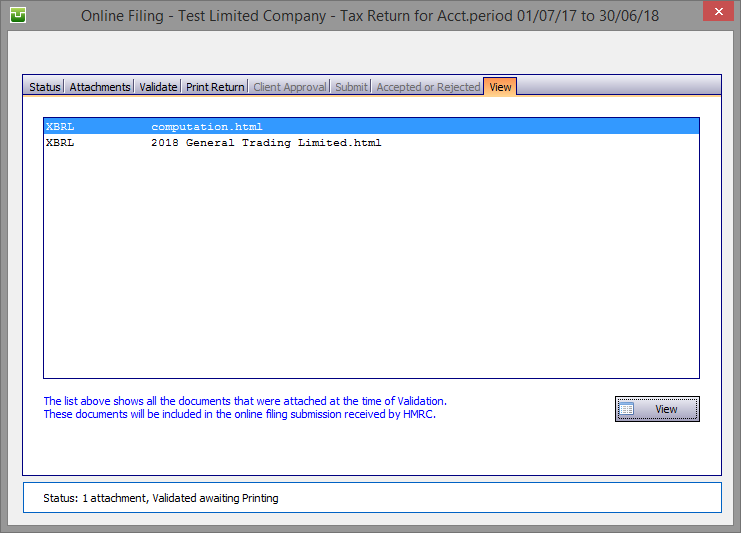

Note that in order to examine the content of any attachment post Validation the View tab is now accessible.

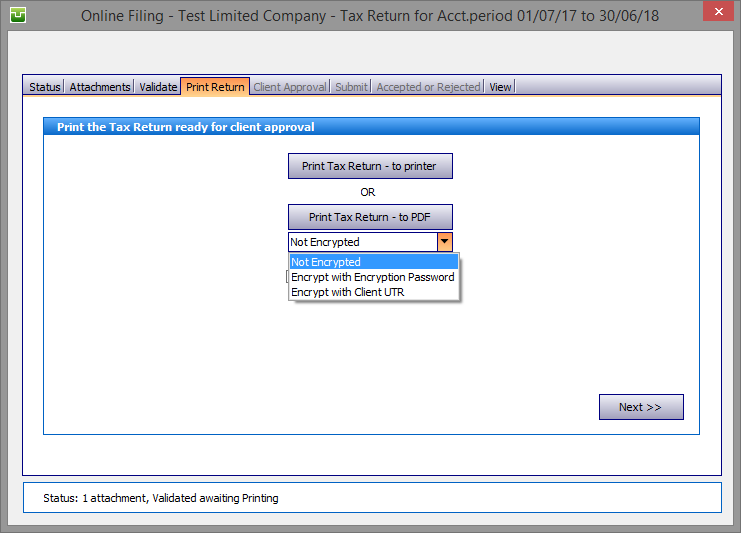

Print Return

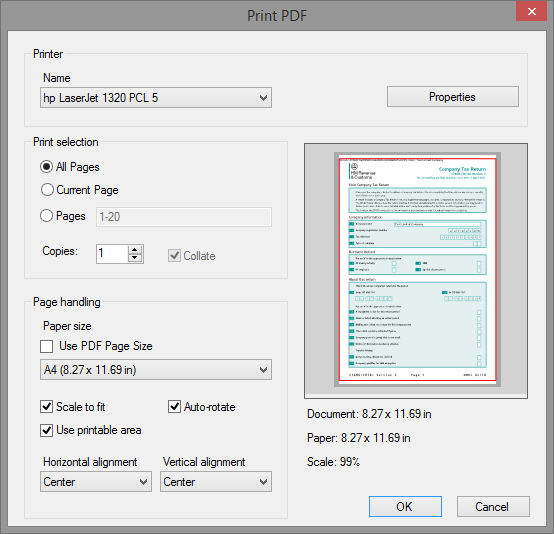

Check the Print IRmark on schedules tick box as required. Note that the when printing to PDF you have the option to encrypt the return by selecting the encryption method from the drop down list. The default setting is Not Encrypted but this may be changed in the Settings/Online Filing tab.

To print the return click on the Print Return tab and select either the to printer or to pdf buttons.

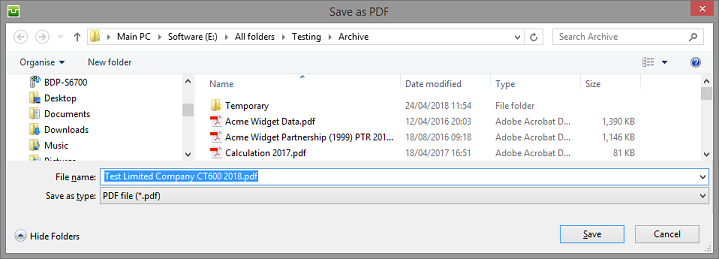

Clicking the .... - to pdf button brings up the Save as PDF screen. Next choose the location within your system where you wish to save the pdf file. In this example the file is automatically named Test Limited Company CT600 2018.pdf although this may be overwritten as desired.

The location shown in the following illustration is an example and not one required by the program. Next click on the Save button.

Click on the Next button on the Print Return tab or on the Client Approval tab.

Client Approval

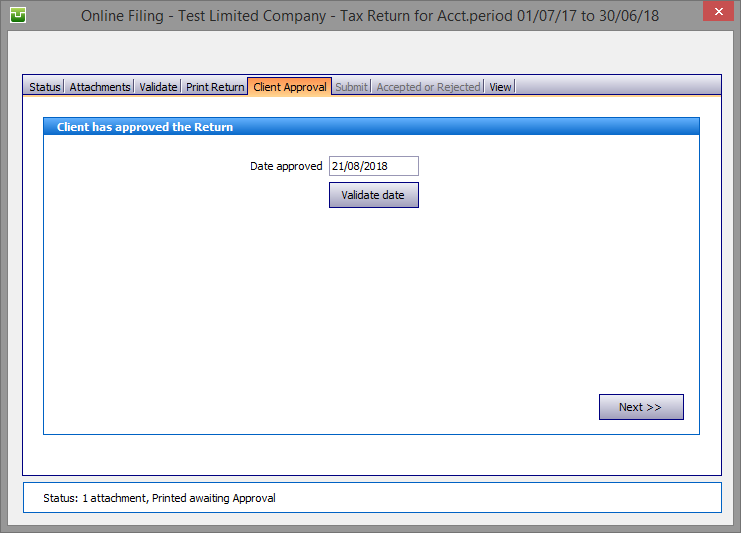

Enter the date on which the client signed the return as approved and hit the Validate date button.

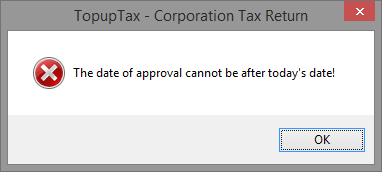

The date of approval cannot be after the current date.

Click on the Next button on the Client Approval tab or on the Submit tab.

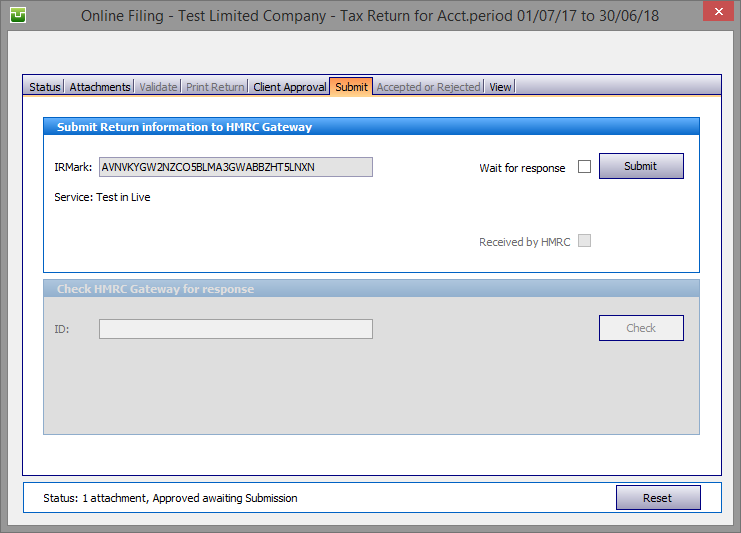

Submit

The return now bears a unique IRMark and is ready to submit to HMRC. Before clicking on the Submit button please check that The Service is set to Live or the submission will not be accepted by HMRC. If it has been set to Test Live (for testing connections etc.) please re-select Live on the Settings/Online Filing tab.

Check or uncheck the Wait for response tick box option as required:

Option a. may be quicker at times when the Government Gateway is busy.

The Received by HMRC tick box is checked by the program to confirm receipt. The ID/IRMark appears in the Check HMRC Gateway for response section. Hit the Check button to receive an Accepted/Rejected message.

Acceptance/Rejection

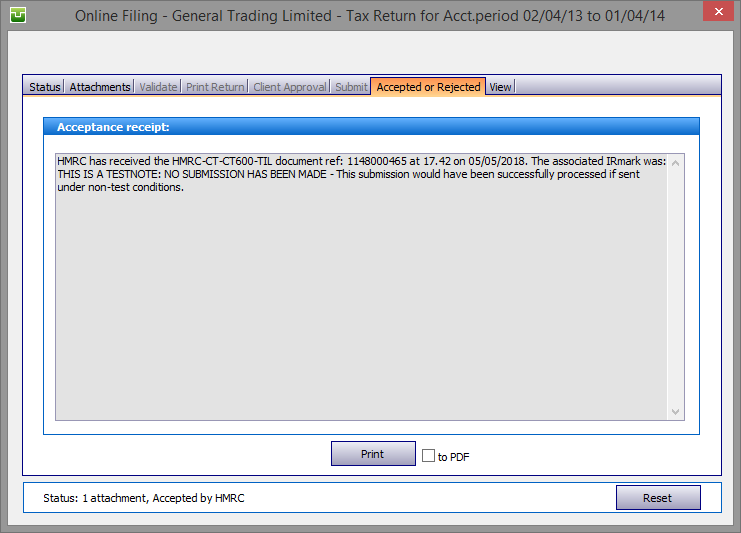

If your submission is accepted:

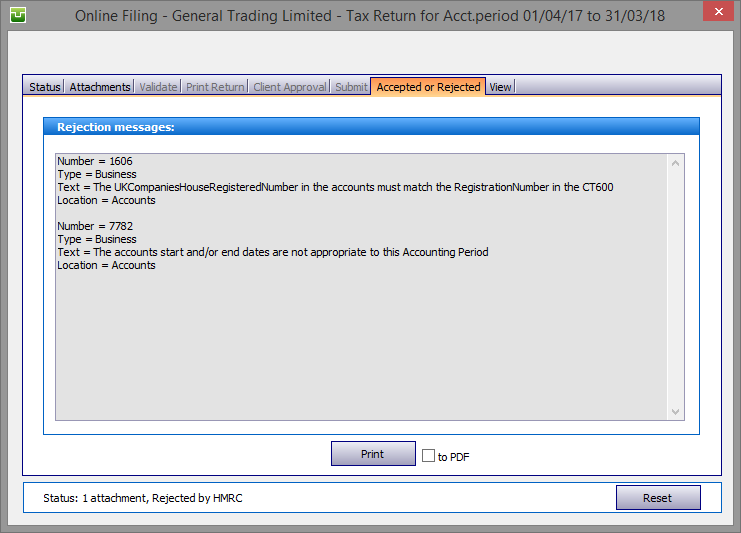

If rejected:

It is recommended that a copy of the Acceptance is printed for record purposes and you may feel it prudent to print a Rejection notice to which to refer pending resolution of the problem.

Click on the Reset button to clear the entire process and once you have corrected the problem it is necessary to repeat it.

Once you have corrected the problem it is necessary to repeat the entire process.

Finally

The Status tab displays the progress of the submission.

Copyright © 2025 Topup Software Limited All rights reserved.