(pages TRG 4) sa150

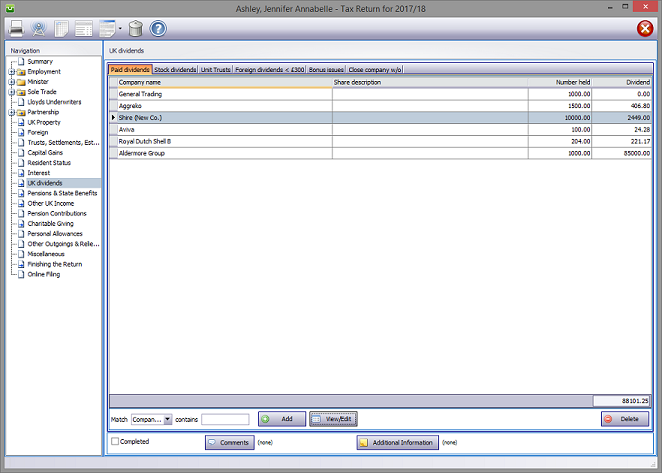

In the Navigation pane click on UK dividends and select the relevant tab.

Please read the HMRC document sa150.

Dividends details

Please refer to New Tax Return.

When you opt to carry forward standing data the program will automatically copy all companies, whether listed or private, from the previous year's tax return into the current one.

Where these companies' dividends are within the database the program will automatically recalculate dividends paid in the subsequent year.

Accordingly these shareholdings should be carefully reviewed to ensure that the number of shares held is correct.

Click on the tab, hit the Add button to make the appropriate entries.

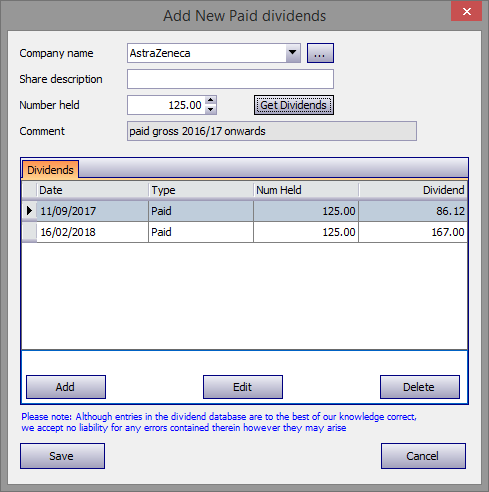

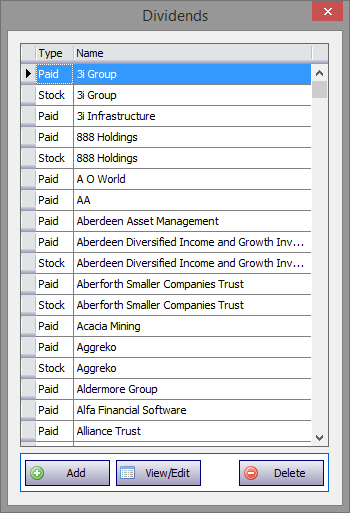

The program contains a database of the top LSE quoted companies. Enter the first few letters of the company concerned and the name of the first one commencing with those letters appears in the Company name box. (in the example the letters "Ag" have been entered)‡ Click on the downward pointing arrow to the right of this box to see the other companies whose names begin with these letters.

Proceed by clicking on the required company, enter the Share description (optional) and the Number held (required) and hit the Get Dividends button. The database will show up to six dividends paid by a company (between 6 April and 5 April the following year) and for which the data is available as at 28 February.

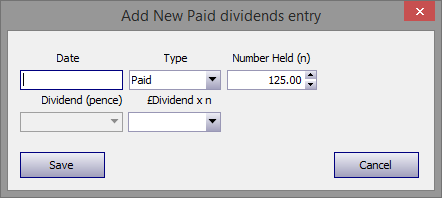

If the database fails to list all dividends paid in the year hit the Add button and make the relevant entries on the Add New Paid dividends entry screen and Save.

If the company you seek is not in the database (possibly an unquoted company) click on the ellipsis (...) to the right of the Company name box to add, delete or edit a company's details.

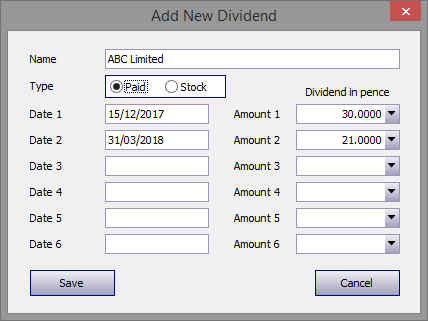

Clicking the Add button brings up the Add New Dividend screen. Enter the relevant data hit the Save button. Be sure to check either the Paid or Stock dividend radio button as required and enter the date of payment in the DD/MM/YYYY format and the amount of the dividend in pence up to four decimal places.

‡ Alternatively click on the downward pointing arrow and scroll down the list of companies in the database.

# Changes in the number of shares held will only affect those rows that have not been manually entered and/or edited.

Stock dividends

Click on the tab, hit the Add button to make the appropriate entries.

This is in every respect similar to Paid dividends except that the dividend database is restricted to companies paying stock dividends.

Click on the tab, hit the Add button to make the appropriate entries.

This is in every respect similar to Paid dividends except that there is no database.

Foreign dividends >£300

Click on the tab, hit the Add button to make the appropriate entries.

This is in every respect similar to Paid dividends except that there is no database.

Non Qualifying Distributions, Close Company Loans w/o (Entries made on these tabs appear in box 13 on page Ai1)

Click on the tab, hit the Add button to make the appropriate entries.

This is in every respect similar to Paid dividends except that there is no database.

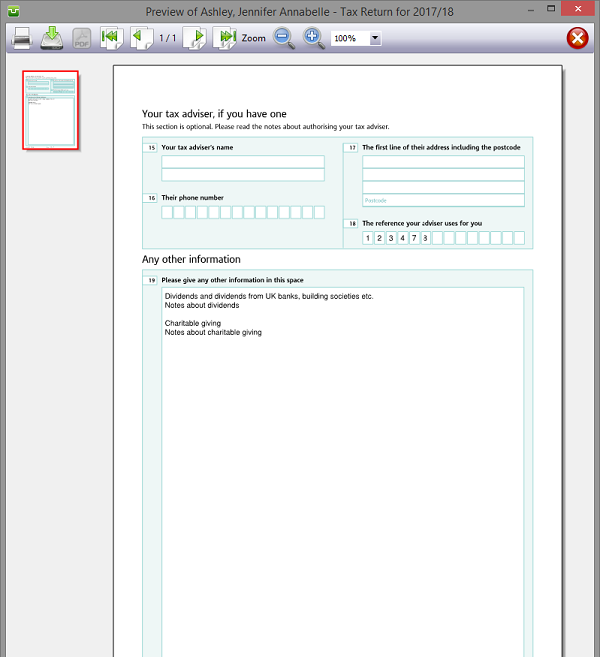

Entries made on the Additional Information area will be printed in box 19 on page TR7 of form sa100. Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of additional information/comments appear to the right of the relevant boxes.

Finishing

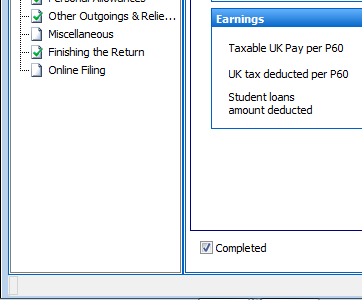

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

| Notes |

| sa150 |

| Page TRG 4 |

Copyright © 2025 Topup Software Limited All rights reserved.