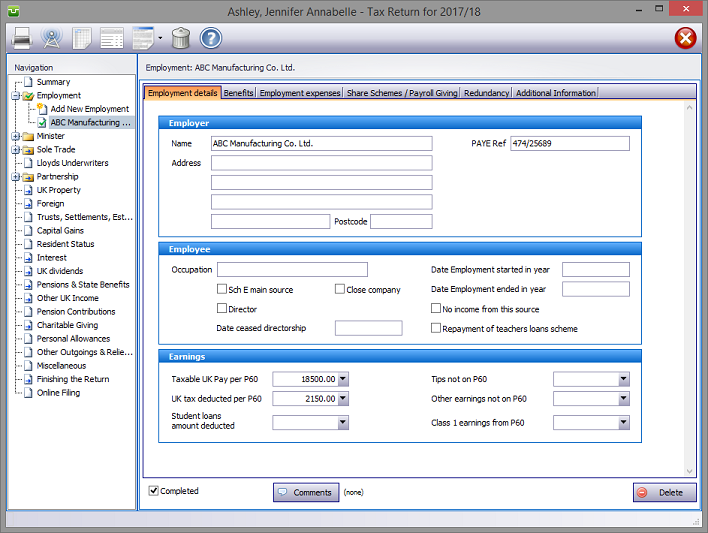

In the Navigation pane click on the +/- sign to the left of the Employment box.

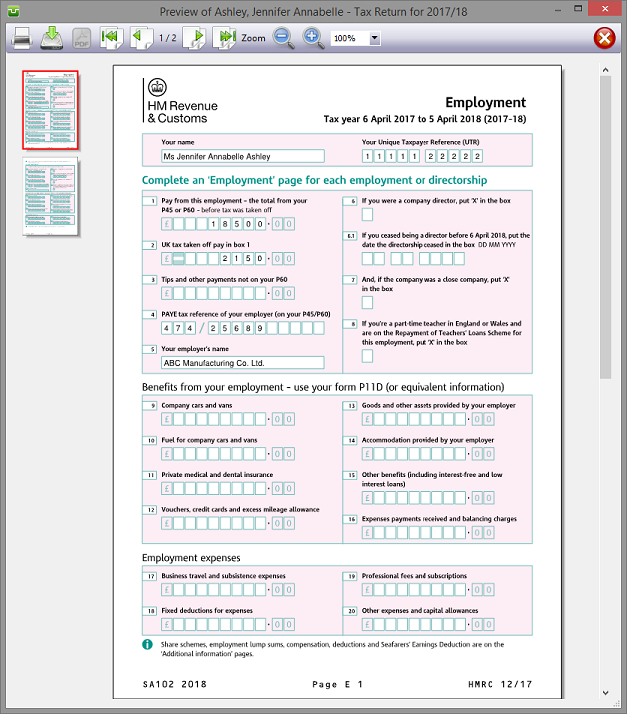

Please read the HMRC document sa102-notes.

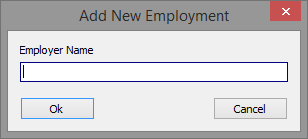

To set up a new employment click on Add New Employment, enter the employer's name and hit the OK button. Otherwise click on an existing employment.

Employment details

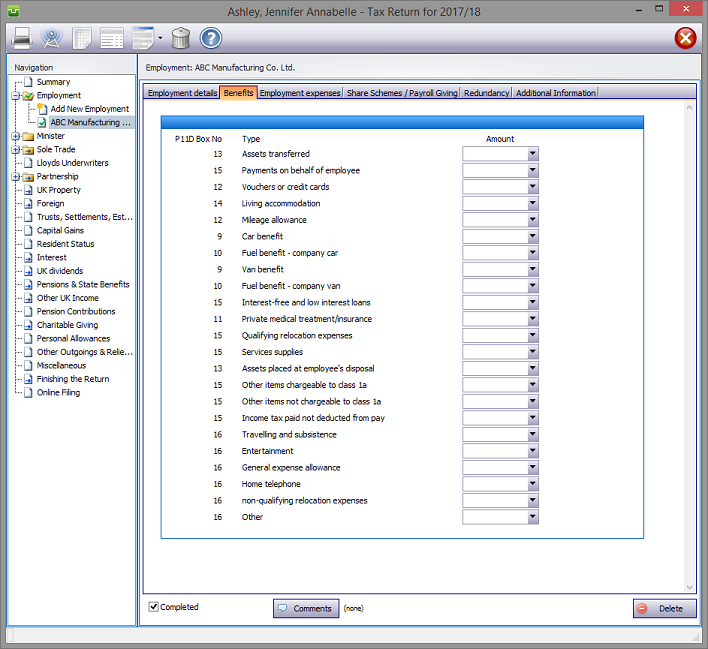

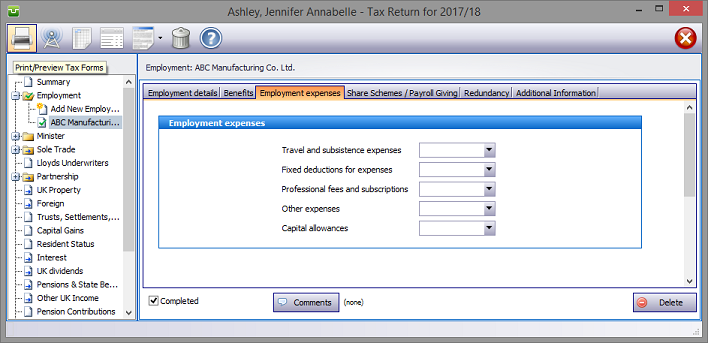

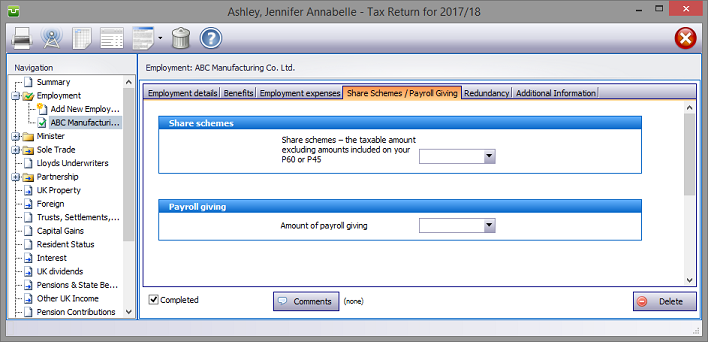

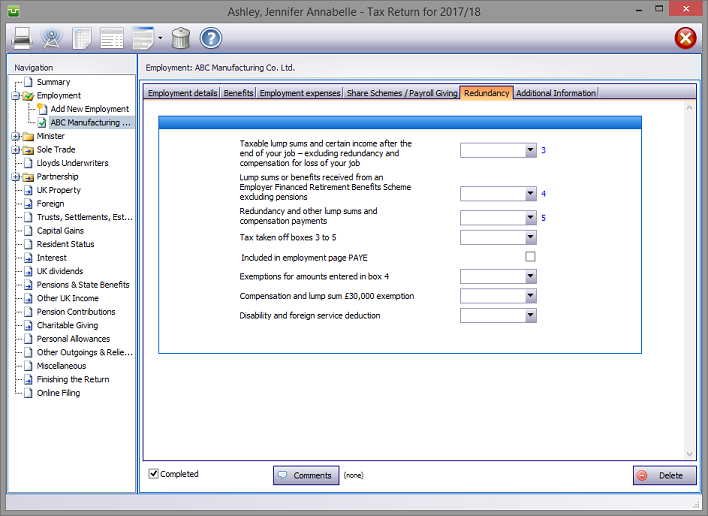

Benefits Employment expenses Share schemes Redundancy

The boxes into which income from benefits are entered are in the same order as on forms P11D.

Other screens

The following are considered self explanatory.

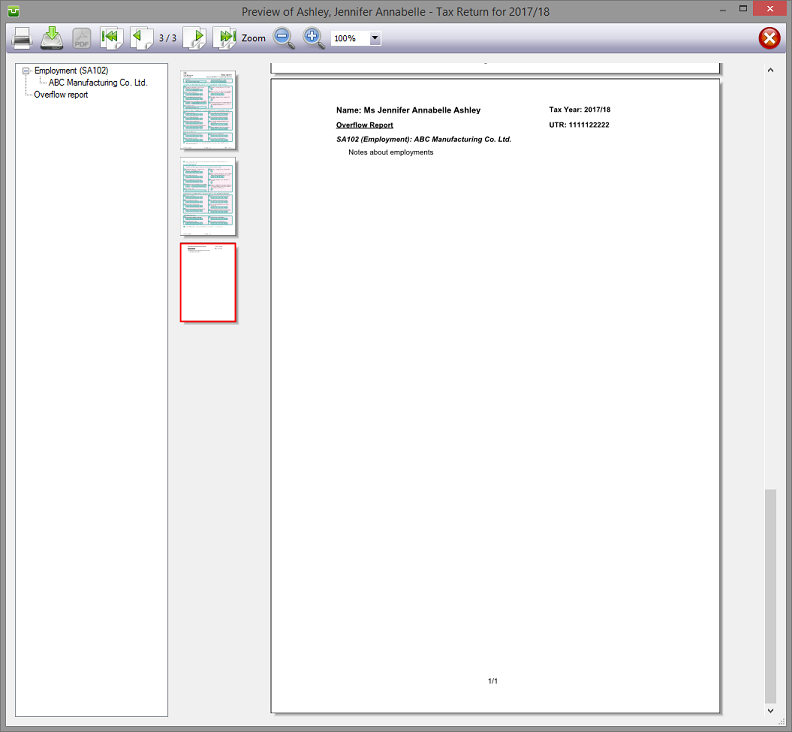

Entries made on the Additional Information tab will be printed as an Overflow Report to supplement form sa102 and is part of the return. Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of comments appear to the right of the relevant boxes.

Finishing

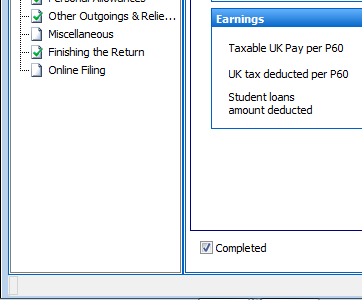

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

| Notes | Helpsheets | ||||||

| sa102-notes | Employments | hs201 | Vouchers, credit cards and tokens | hs207 | Non-taxable payments for employees | hs212 | Tax equalisation |

| hs202 | Living accommodation | hs208 | Payslips and coding notices | hs213 | Payments in kind assets transferred | ||

| hs203 | Car benefits and car fuel benefits | hs210 | Assets provided for private use | hs252 | Capital allowances and balancing charges | ||

| hs205 | Seafarers’ Earnings Deduction | hs211 | Employment residence and domicile issues |

Copyright © 2025 Topup Software Limited All rights reserved.