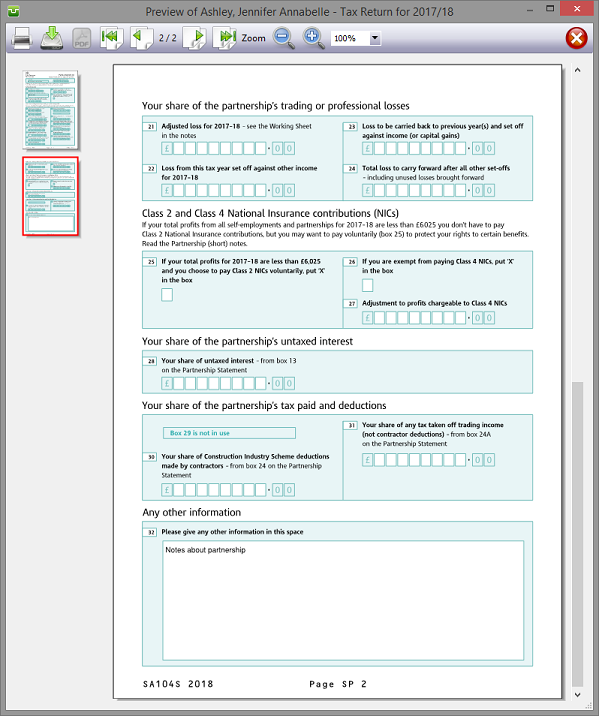

| sa104s |

| sa104f |

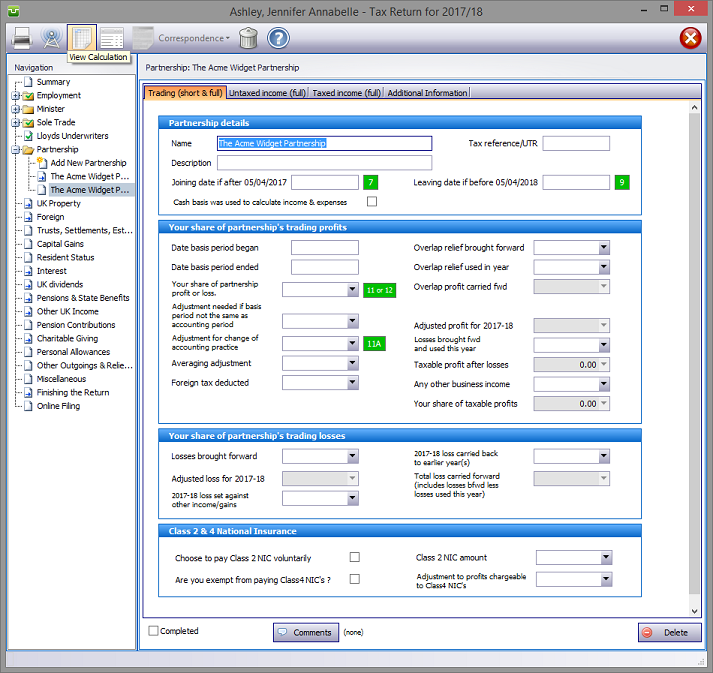

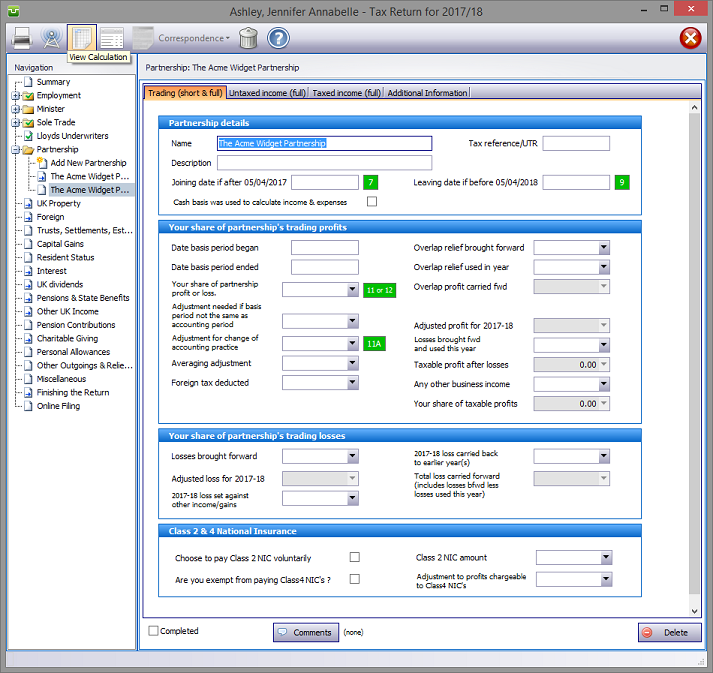

In the Navigation pane click on the +/- sign to the left of the Partnership box.

Please read the HMRC documents sa104s-notes and sa104f-notes.

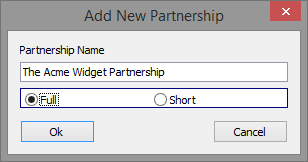

To set up a new partnership click on Add Partnership, enter the partnership name and hit the OK button. Otherwise click on an trade.

Partnership details

Whilst entering data is intuitive and self explanatory, please ensure that

Note:

Note:

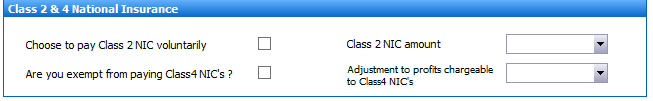

Class 2 NICs

From 6 April 2016 Class 2 NICs are to be included in the trading and partnership pages and tax computations. HMRC have a digital record of class 2 NICs which they use in their calculations of liability. Unless you ensure that you enter the correct figures your calculations won't agree with HMRC's.

The entries need to be made on the Calculating Profit & Losses or Taxable Profits, Losses etc or Trading tabs for pages SA103F, SA103S, SA104F or SA104S.

If in future HMRC allow developers access to their database it will be possible automatically include this data in their applications.

Interaction with Partners' personal returns

Firstly, if you have manually set up any forms sa104, to avoid possible duplication, it is advisable to delete them.

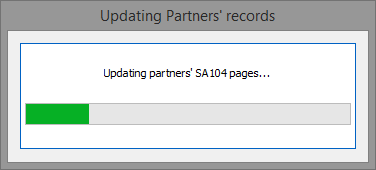

Provided the partners' personal current year tax returns have been created within the program, forms sa104 will be automatically produced to include the shares of partnership income. This transfer/update process occurs whenever you exit a partnership return.

Entries made on the Additional Information tab will be printed as an Overflow Report to supplementary form sa104(F) {or in box 32 on form SA104(S)} and is part of the return. Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of comments appear to the right of the relevant boxes.

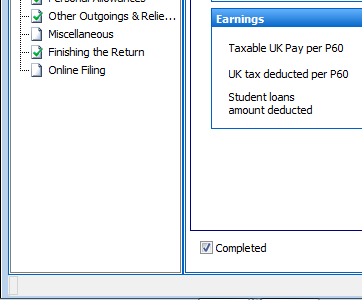

Finishing

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

| Notes |

|

||||

| sa104s-notes | Partnership short | hs231 | Doctors’ expenses | ||

| sa104f-notes | Partnership full | hs380 | Partnerships: foreign aspect |

Copyright © 2025 Topup Software Limited All rights reserved.