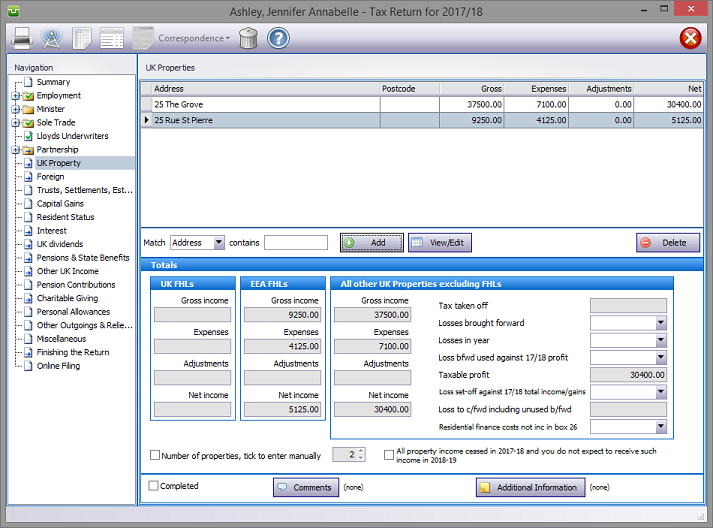

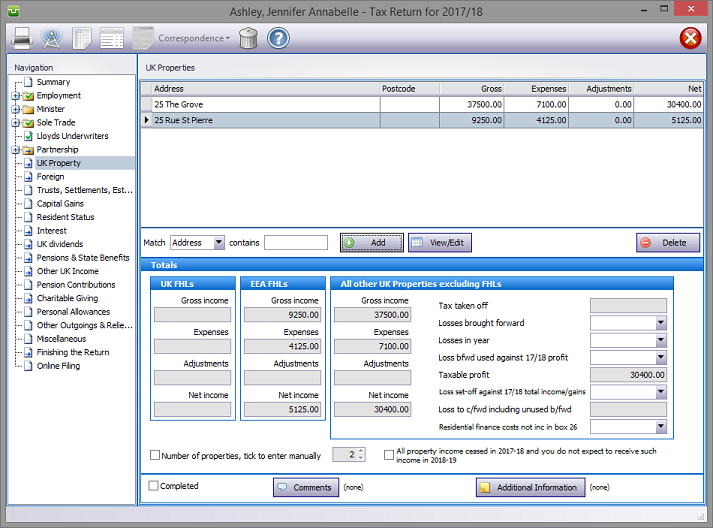

In the Navigation pane click on UK Property.

Note: In order to clearly identify UK FHLs and EEA FHLs the program lists these separately from UK Unfurnished and Furnished rentals.

Note the Residential finance costs not inc. in box 26 i.e. the disallowed interest excluded from the entries in the Income and Expenses section.

Please read the HMRC document sa105-notes.

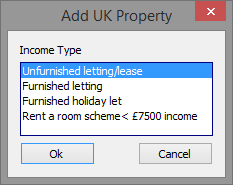

Next hit the Add button to select the type of income from property.

UK Property details

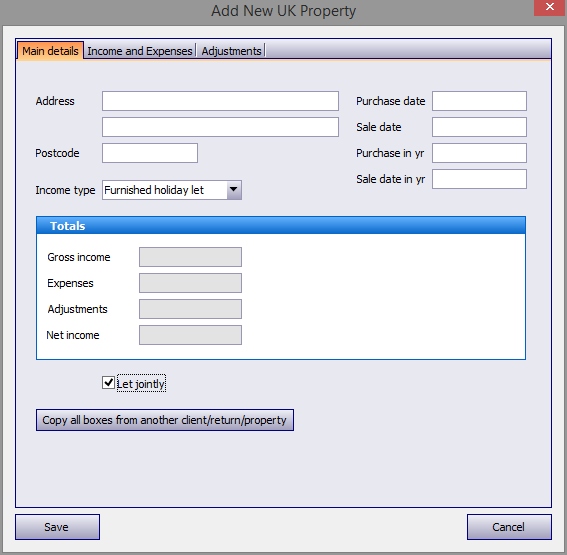

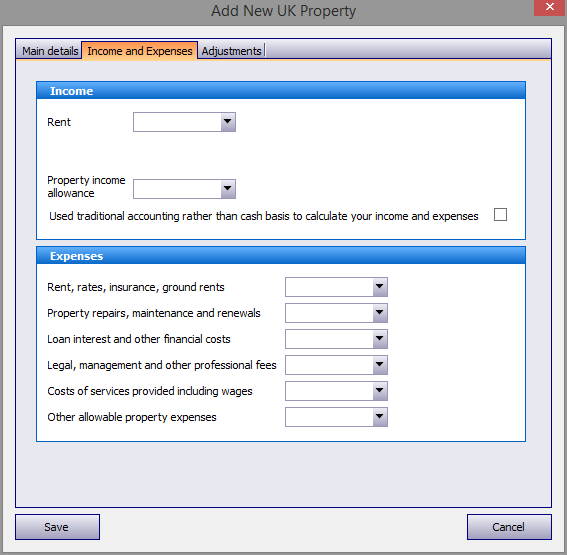

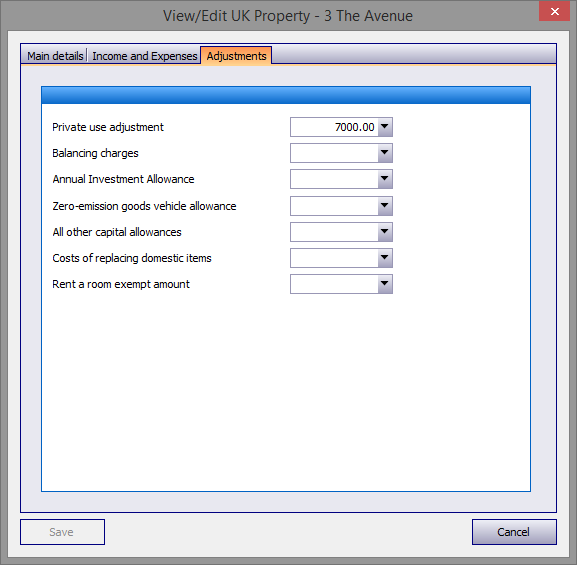

Select Income Type and hit the Ok button. Enter the property address etc. on the Main details tab and the income etc. via the Income and Expenses and Adjustments tabs.

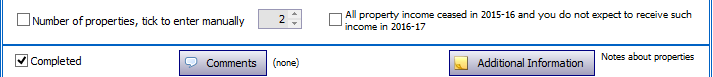

Note the Property income allowance box in the following screen. Where the entry here is no more than £1,000 (the total income of all properties before deductions) it will be disregarded in calculating tax liabilities.

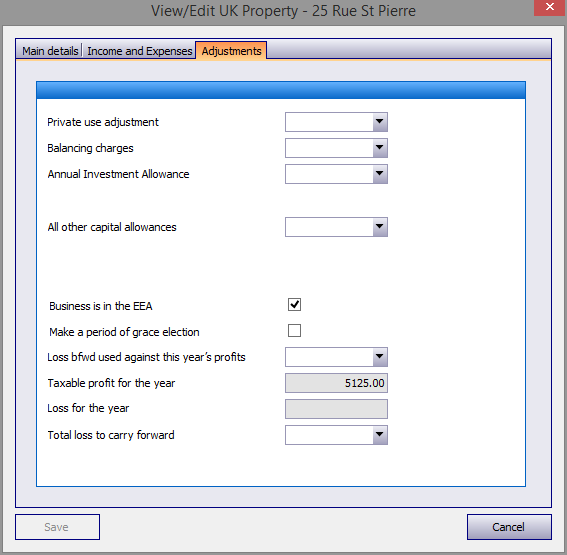

The letting will be included in the return as an EEA FHL if the Business is in the EEA box is checked.

If your client shares income and expenditure with another ensure that the Let jointly tick box is checked.

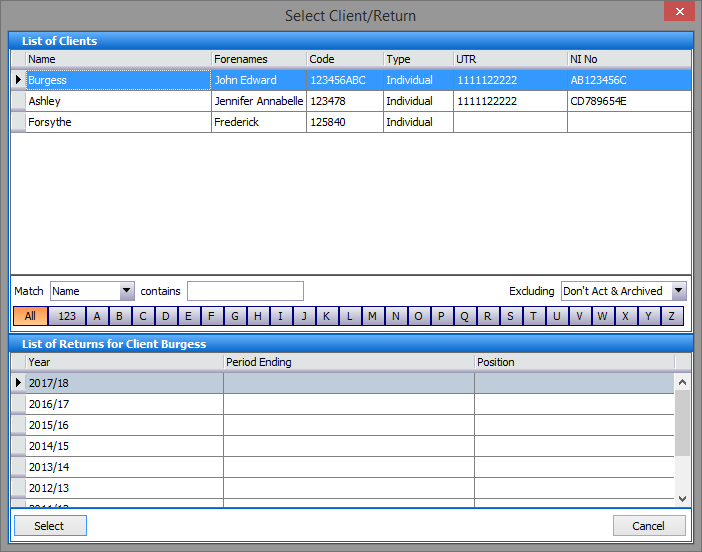

If the joint letting is with another client in your database you may avoid manually re-entering the data by clicking on the Copy all boxes etc. button. This takes you to the Select Client/Return screen, the upper part of which contains the same search facilities as List Clients; the lower area repeats the List Returns information.

Firstly, highlight the client and the tax year/return from which data is to be copied then click the Select button.

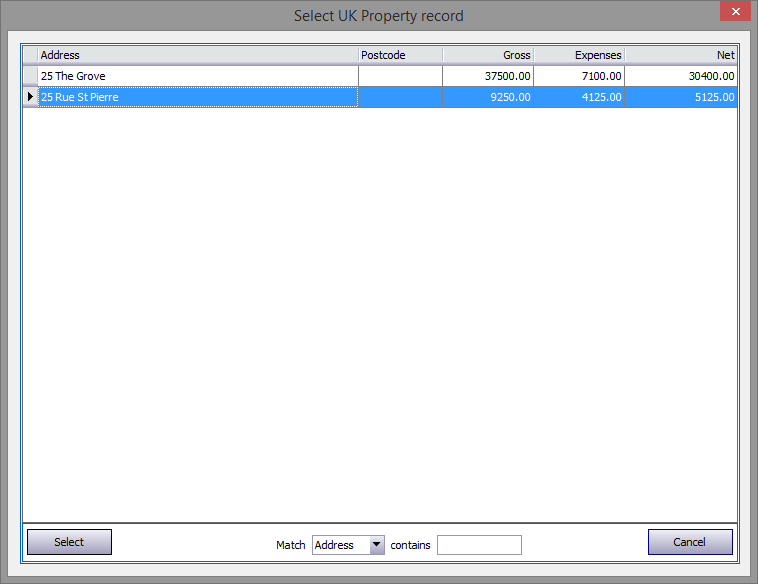

From the list of properties highlight, one by one, the properties you wish to copy and hit the Select button.

Since the program will duplicate all data, where the income etc. is not shared equally it will be necessary to manually make the necessary changes via the Income and Expenses and Adjustments tabs.

Rent a room

When entering income covered by the Rent a room allowance use the Adjustments tab to insert the amount of the relevant exemption. For example in the "Private use adjustment" box.

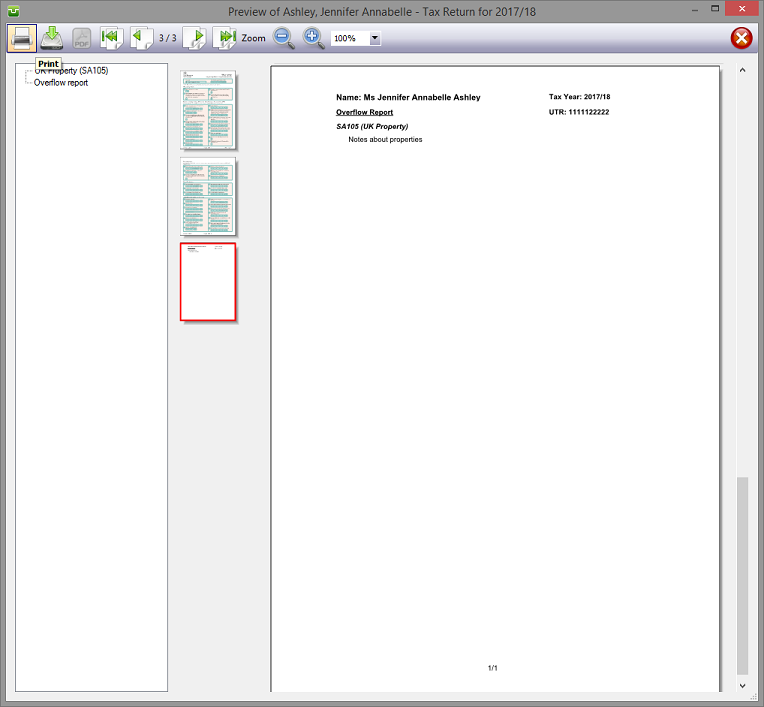

Entries made on the Additional Information tab will be printed as an Overflow Report to supplement form sa105 and is part of the return. Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of additional information/comments appear to the right of the relevant boxes.

Finishing

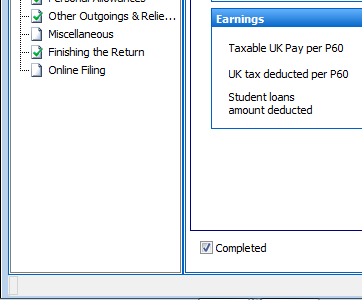

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

Where all sources of property income finishes ensure that standing data is not carried forward to later years by checking the All property income ceased.... tick box in the lower right hand corner of the screen.

| Notes | Helpsheets | ||

| sa 105-notes | UK Property | hs223 | Rent-a-Room for traders |

| hs251 | Agricultural land |

Copyright © 2025 Topup Software Limited All rights reserved.