Click on the Reports icon (second from left).

Reports produces lists of clients reflecting entries in the Status area of the Client List. It also provides access to Bulk Data Request used to produce multiple requests to clients for the data you need to complete their tax returns (presently only available for Individual returns).

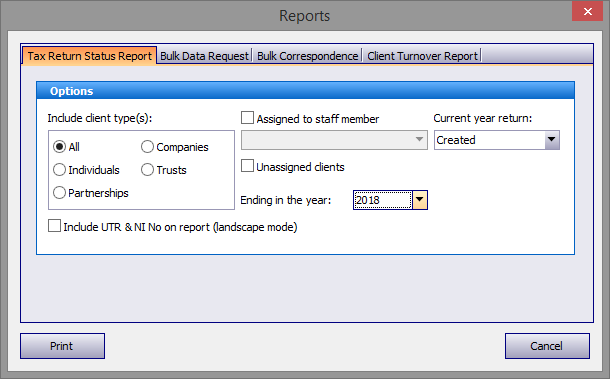

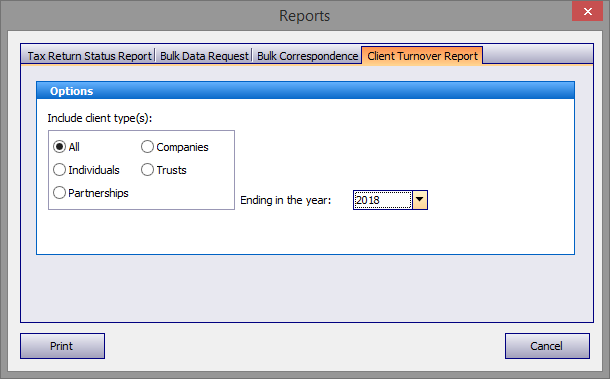

Click on one of the All, Individuals, Partnerships or Companies radio buttons to select the client type for whom you wish to produce a report and hit the Print button.

By default the program will list the status of returns for the current year but this may be changed by clicking on the drop down arrow to the right of the Ending in the year: box and selecting the period required.

Use the drop down arrow to the right of the Current year return box to filter entries on the report at various stages of the submission process.

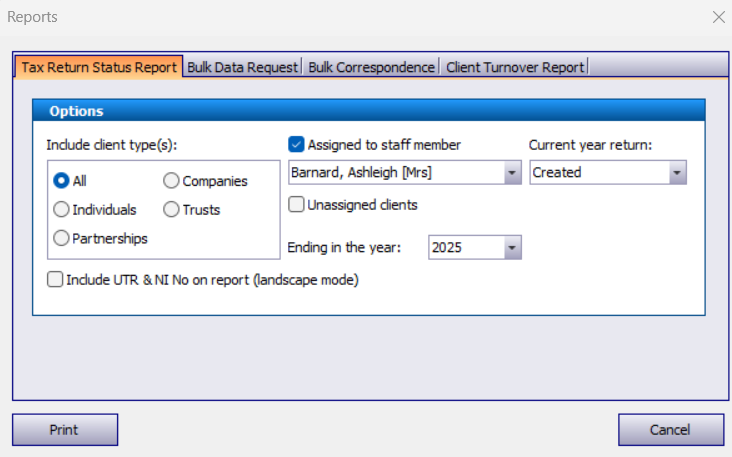

This process may be further refined by checking the Assigned to staff member tick box then clicking on the drop down arrow to the right of this box. Check the Unassigned clients tick box should you wish to list clients for whom no staff member has, as yet, been assigned.

Next click on the operative for whom the list is required and hit the Print button..

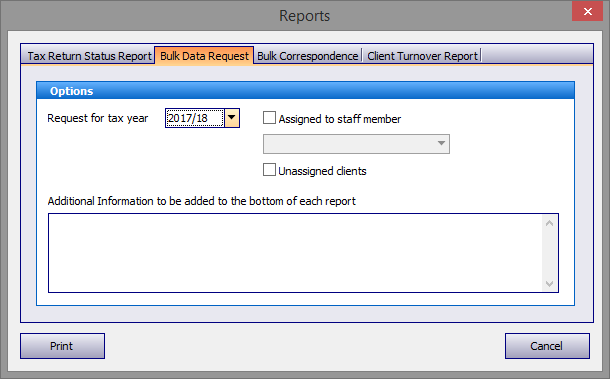

Click on the Bulk Data Request tab then hit the Print button.

As above the process may be refined by checking the Assigned to staff member etc.

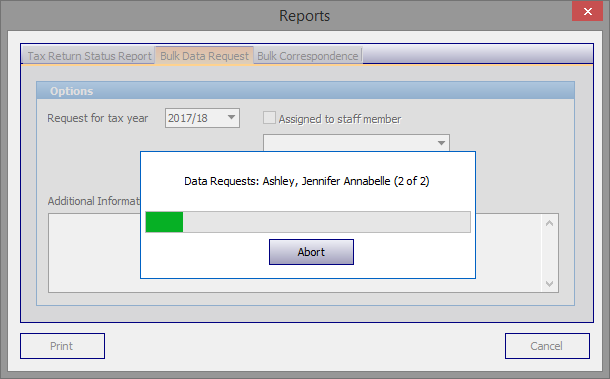

The program compiles data requests for those clients for whom you prepare Individual tax returns.

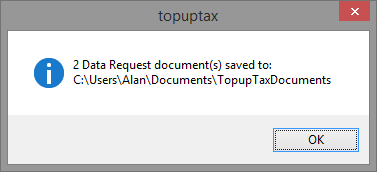

Finally this screen confirms that the process is complete.

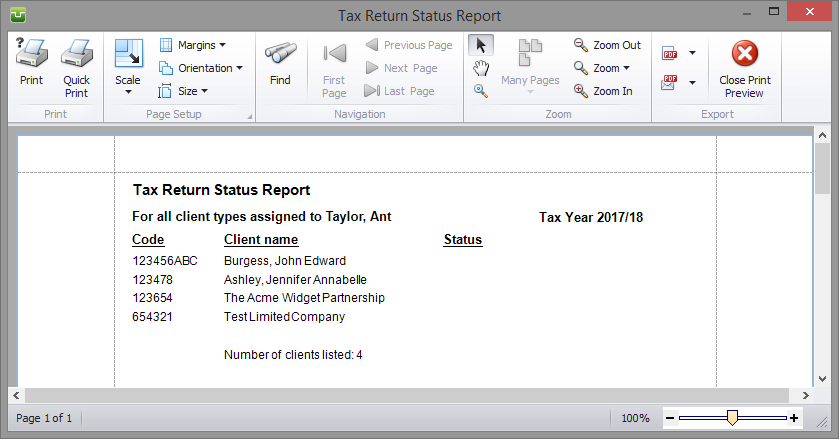

Note: In this example only four "Demo" clients are shown. In a real time test (SQL Express database containing around 300 clients) the process took less than five minutes.

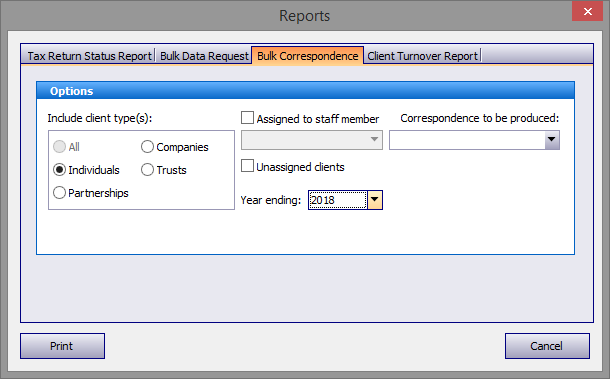

Bulk Correspondence

Use this facility to produce identical multiple letters to clients on any subject matter for which you have created a template. Selection process is similar to Tax Return Status Reports .

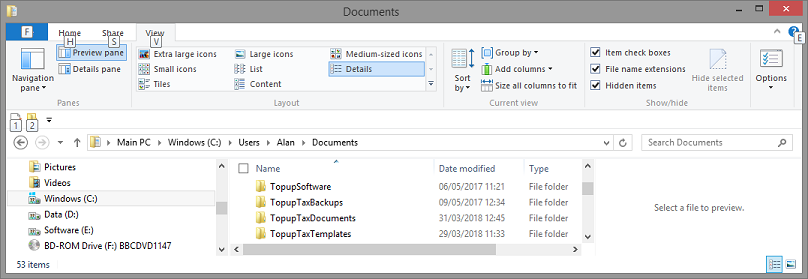

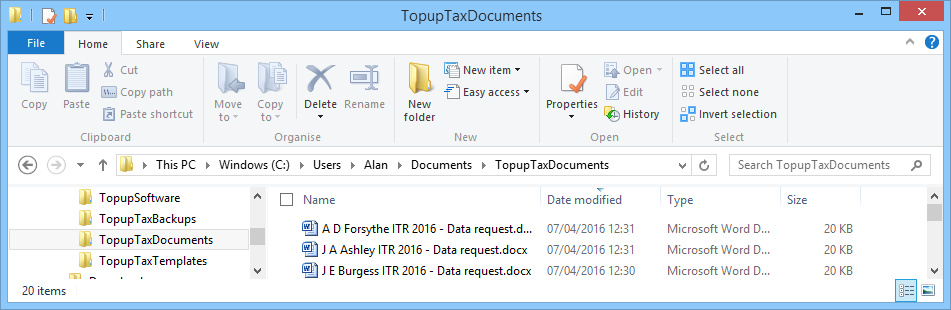

Individual data requests are stored as RTF files in C:\Users\Documents\Topup TaxDocuments.

Note: This folder (also used to store documents created by the Correspondence routine) is intended for temporary storage of your documents prior to transferring these to specific locations within your filing system.

Note: Rich Text Files (RTF) can be printed etc. by most word processing programs.

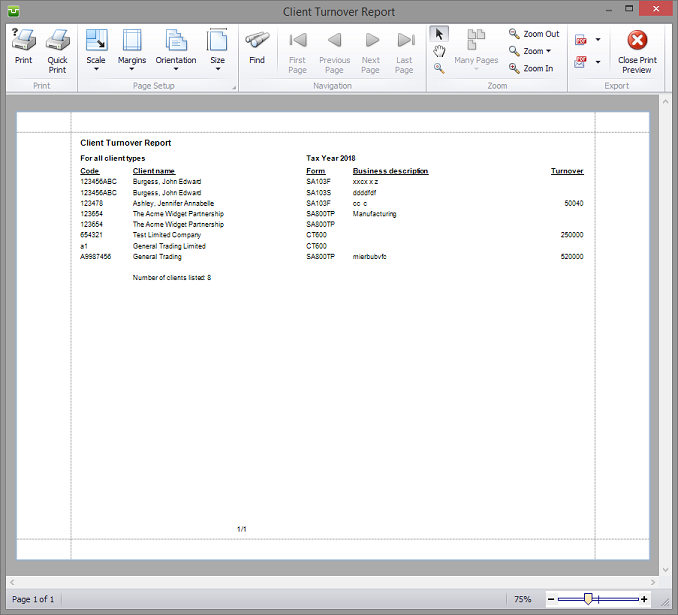

Client Turnover Report

If you use Visual Transaction for your bookkeeping and preparing VAT returns you will be aware that as from April 2019 these may only be submitted to HMRC using software compatible via MTD (Making Tax Digital). Although there are a number of products which will link VT to HMRC, using Absolute Tax Filerprovides a straightforward means of accomplishing this.

Copyright © 2025 Topup Software Limited All rights reserved.